Welcome to another Microjourney with me, Liam Sturgess. Whether you’re reading this on Substack or watching live on video, thank you for joining me, and I hope you find this discussion as interesting as I do.

For some background on today’s topic, I recommend reading my article from yesterday if you haven’t had the chance to yet:

And finally, I invite you to sign up for a paid subscription to this series. I have recently chosen to go independent in my investigative journalism, and your financial support will allow me to continue to learn and share on my own terms.

The crisis ends, the passport expands

On Monday, June 5th, the World Health Organization and the European Commission issued a joint statement announcing the introduction of the WHO Global Digital Health Certification Network.1 What was formerly a vaccine passport system implemented across member states of the European Union will now be reaching across borders, with WHO Director General Tedros and EU Commissioner Stella Kyriakides boasting that the “EU Digital COVID certificate is being scaled up to global level.”

YouTuber John Campbell briefly covered this announcement, and I thought he did a great job highlighting the absurdity of the situation with his wry and somewhat frustrated sarcasm. I recommend checking his video out.

This may come as a surprise to some, given the fact that the WHO declared the COVID-19 pandemic to be officially “over” exactly one month prior.2 Clearly, something about the COVID passport system is important enough to carry through into the next phase of “normal.” The timing of this announcement is sort of crazy, as I was just preparing to finish a piece on vaccine passports which may help fill in the historical gaps of how the WHO’s decision to charge ahead could possibly make any sense at all.

Let’s dive in.

How Mastercard saved Africa

Much like everything else in modern life, health data has been undergoing a decades-long process of converting from paper records to digital. Entire industries have been created around this transition, and the surge of innovation has resulted in the formation of several prominent public-private partnerships to explore the legal and ethic implications of putting everybody’s private medical information on the internet.

Closely tied with this bigger push to digitize everything, everywhere, is the global use of smart phones for increasingly many functions. But the rapidly-expanding network of digital ID systems, as odd as it sounds, are being set up to work with or without a smartphone, including on cards in the form of traditional ID equipped with specialized chips.

Mastercard is one of the world’s largest financial services companies, recognizable as one half of a functional payment processing duopoly with its competitor and collaborator, Visa.3 But less known is its forays into digital identification, and its controversial experiments with its programs in various parts of Africa and other lower-income countries.

National Identity Smart Cards in Nigeria

![New National-eID-card [PHOTO: amediaagency] New National-eID-card [PHOTO: amediaagency]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F36f1ec3a-11f5-41d4-a7a8-4de1005e729b_1024x619.jpeg)

In August 2014, the Nigerian Government’s National Identity Management Commission (NIMC) rolled out a new national ID card branded with Mastercard’s logo. This was met with outrage from Nigerian citizens and civil rights group alike.4

“The new ID card with a MasterCard logo does not represent an identity of a Nigerian. It simply represents a stamped ownership of a Nigerian by an American company,” said Shehu Sani of the Civil Rights Congress. “It is reminiscent of the logo pasted on the bodies of African salves (sic) transported across the Atlantic.”

Just as with the authors of the Fortune article from the COVID-19 era (which I discussed in my previous article), Nigerian critics of Mastercard’s program “raised the alarm over the implications of the agreement in an age that has seen intense data surveillance by the National Security Agency of the United States of America, MasterCard’s home country.”

Specifically, the move “would surrender a symbol of national sovereignty and pride to a foreign commercial organisation by not only sharing the biometrics of 170 million Nigerian (sic) to the firm but by also allowing the firm to boldly engrave its insignia on the IDs.”

Indeed, the Mastercard-branded national ID cards were equipped with multiple capabilities previously separated for security and privacy reasons, such as for tracking and storing biometrics, and “to also allow handlers effect payments and other financial transactions.” Despite being deployed as a pilot project, they were also “expected to serve as voting cards in the 2019 elections,” which were at that point nearly five years away. Further, the “Identity Management Commission said it was working with other government agencies to harmonize all identity databases including the Driver’s License, Voter Registration, Health Insurance, Tax, SIM and the National Pension Commission into a single, shared services platform.” All of this data, according to former Federal Capital Territory Minister Nasir El-Rufai, “go to the American payment platform.”

Of course, one might also note the dark irony in the company’s name itself, adding what is surely inadvertent insult to injury. After all, this Smart ID program was mandatory, not something a Nigerian citizen could choose to opt in or out of.

In addition to the National Identity Management Commission and MasterCard, partners on the project included:5

Access Bank (now Africa’s largest bank)6

Cryptovision (a digital ID and biometrics company, now called Eviden)

Unified Payment Services (which is “owned by a consortium of leading Nigerian banks,” and originally called SmartCard Nigeria)78

Fidelity Bank Nigeria, First Bank of Nigeria, Skye Bank, Stanbic IBTC Bank, Standard Chartered Bank, Union Bank, United Bank for Africa, Unity Bank and Zenith Bank as the first round of “issuing banks.”

Note that MasterCard,9 Access Bank,10 First Bank,11 Standard Chartered Bank12 and Zenith Bank13 are partner organizations of the World Economic Forum, as is Stanbic’s parent company, Standard Bank Group.14

As it turns out, this is not merely a passing connection: the National Identity Smart Cards project was officially announced at the World Economic Forum on Africa in May 2013. In the announcement, NIMC Director General Chris Onyemenam explained that MasterCard was their payment provider of choice because of their “commitment to furthering financial inclusion through the reduction of cash in the Nigerian economy.” MasterCard’s President for the Middle East and Africa, Michael Miebach, elaborated, saying the company “has been a firm supporter of the Central Bank of Nigeria’s Cashless Policy as we share a vision of a world beyond cash.”15

The new identity smart card will incorporate the unique National Identification Numbers of duly registered persons in the country. Enrollment involves recording demographic and biographical data as well as the capture of 10 fingerprints, facial image and a digital signature that are used to authenticate the cardholder.

It is perhaps alarming for some to consider the scale and scope of data capture involved in MasterCard’s “Smart Cards” program. This followed the plan announced by the Nigerian government in 2012 to require “biometric registration that involves capturing and enrolling all detailed information of an individual,” firmly locking in everything from “payment services, transit, identity, economy, health and education.”16 In January of 2013, the government announced it had “started a comprehensive biometric capture exercise” modelled after the “Aadhaar program initiated by the Unique Identity Authority of India, which similarly aims to capture the biometrics of all of India’s 1.2 billion habitants.”17 MasterCard’s announcement at the World Economic Forum took place only four months later.

Among the other participants at that WEF event were the Bill & Melinda Gates Foundation, Boston Consulting Group (BCG), JPMorgan Chase, McKinsey & Company, Microsoft, vaccine giant Novartis and the Rockefeller Foundation.18

Mastercard Wellness Pass

In July 2017, Mastercard teamed up with Gavi, the Vaccine Alliance and the World Health Organization on a trip to the African nation of Mauritania to conduct an audit of their national immunization program. Finding that the country had “a high vaccination dropout rate, low household coverage of immunisation cards, incomplete immunisation records at household, facility and programme levels, and erroneous estimates of dropout and coverage rates for some localities,” Mastercard and Gavi agreed to step in and engineer a solution.19

This came in the form of a proposed ‘Mastercard Wellness Pass,’ which was workshopped at subsequent meetings in November 2017 and March 2018. Gavi received a thumbs up from Mauritania’s Minister of Health at the World Health Assembly in May 2018, and the Wellness Pass was officially announced to the world on December 11, 2018.20

Much like Nigeria’s National Identity Smart Cards, the new pass would collect a slew of information on the holder, following them through the rest of their lives. It was described both as “a digital birth certificate” and “a credit card.” The Wellness Pass, however, was explicitly marketed with Gavi as a way to increase uptake of vaccines, and would be created for each infant upon receiving their first shot.2122

The pilot project received $3.8 million USD in funding from the Bill & Melinda Gates Foundation, and plans were quickly drawn up to expand the program to Burkina Faso, Ghana, Uganda and Mozambique in the following years.

Mastercard Digital Wellness

On June 7, 2019, Mastercard announced a similarly-named program called Mastercard Digital Wellness. Despite what its name may suggest, the program was focused on a suite of digital tools to “enhance transparency, security and choice for online shopping.”23

This included integrations with EMVco — an alliance formed by Mastercard and several of its competitors including Visa, American Express, Discover, Japan Credit Bureau (JCB) and UnionPay24 — and NuData, a subsidiary of Mastercard focused on cybersecurity and artificial intelligence.25

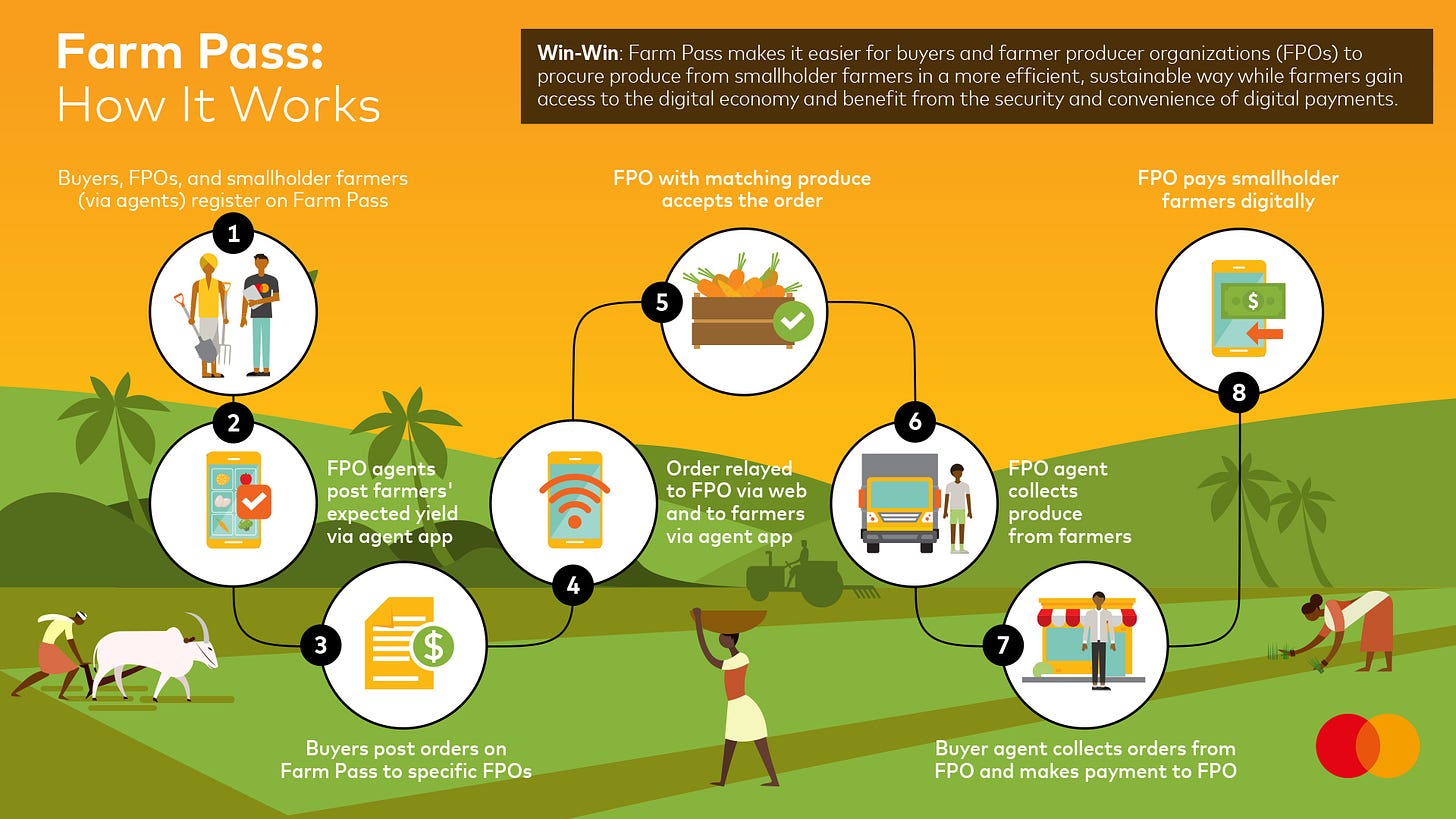

Mastercard Farm Pass

On September 25, 2019, Mastercard announced a strategic partnership with Rabobank to expand their Mastercard Farm Pass program to “one million farmers in emerging markets” across Uganda, Tanzania, Kenya, Ghana, Egypt and India.26 As later press releases would elucidate, the Farm Pass had launched its first pilot back in 2015 in Kenya.27

Mastercard Community Pass

Then, to tie all of these separate programs together, Mastercard launched their Mastercard Community Pass on October 16, 2019. The platform would be “connected into a broader ecosystem where individuals can be recognized as the same person” when engaging with finance, agriculture, education, housing and healthcare.28

Mastercard’s response to COVID-19

On March 10, 2020, Mastercard joined the Bill & Melinda Gates Foundation and Wellcome Trust in committing up to $125 million towards the creation of the COVID-19 Therapeutics Accelerator.2930

By the end of March, a number of pharmaceutical and biotechnology companies announced their participation. Among those companies were BD, Boehringer Ingelheim, bioMerieux, Eli Lilly, Gilead Sciences, GlaxoSmithKline, Johnson & Johnson, Merck, Novartis, and Pfizer — all of whom developed and deployed experimental therapeutics, vaccines and/or diagnostics in response to the declared pandemic.31 In particular, GSK, J&J, Merck, Novartis and Pfizer all held financial interest in COVID-19 vaccine candidates that would go on to be included in vaccine passport programs like Mastercard’s.

On June 3, 2020, Gavi announced that Mastercard would “adapt its Wellness Pass solution for the COVID-19 response.”32 Its new Wellness Pass for COVID (WP4C) was described as “an upgraded version that allows for identification, enrolment, and tracking of COVID-19 cases and COVID-19 vaccinees.”33

But the development process of their digital ID wasn’t quite complete. On June 26, Mastercard revealed that a startup called Trust Stamp was “working with Mastercard to integrate its digital identity capabilities” into the Wellness Pass, which was finally preparing to launch in earnest alongside Gavi in West Africa.34 The Wellness Pass would also integrate the AI capabilities of NuData, as previously implemented into the Mastercard Digital Wellness program.35

Trust Stamp was founded in 2016 by Gareth Genner and Andrew Gowasack as a digital identity company.36 It received early support from the Plug and Play Tech Center, a “global innovation platform” based in Silicon Valley. Plug and Play’s investment portfolio includes Dropbox, Honey, and PayPal, as well as Token, an “open banking” startup founded by Steve Kirsch.

Interestingly, Token is itself a collaborator of Mastercard. On February 13, 2019, Token announced it had been “selected by Mastercard to power the connectivity layer of its open banking hub.”37 Mr. Kirsch himself weighed in:

Token isn’t Kirsch’s only venture based in the realm of digital ID. In 2011, he founded OneID, a startup that sought to establish “a new kind of ‘single sign-on’ security for the Web” by unifying all of one’s devices to create a multi-layer ID verification system. One application of his idea, for example, is merchants being able to “establish your identity at a checkout stand by holding a phone over a scanner.”38 OneID was acquired around 2016 by Neustar, which itself was acquired by TransUnion in December 2021.39

One of the financial backers behind OneID was Khosla Ventures, a venture capital firm whose portfolio also includes Deep Genomics40 (advised by Moderna alum Tal Zaks),41 Square42 and Tile43 — the latter two of which recently made the news following the murder of Bob Lee.

Plug and Play’s website prominently lists its partners as including Amazon, Bayer, Canada Post, Canadian National Railway, Facebook, Merck, Northfolk Southern, Pfizer, Roche, the Society of Actuaries, Visa, Walmart, among many others — including, of all things, the United States Agency for International Development (USAID).44 An archived version of the same webpage reveals that as of at least May 2020, Plug and Play was also partnered with AstraZeneca, Johnson & Johnson, and the Bill & Melinda Gates Foundation.45 Also notable is the International Air Transport Association (IATA), who unveiled their own IATA Travel Pass in response to the declared COVID-19 pandemic.46 The pass was, indeed, designed as a rather literal vaccine passport, also incorporating results of PCR or rapid antigen tests for SARS-CoV-2.47

All-industry approach

As we’ve seen, what we’ve come to know as a ‘vaccine passport’ is really just another iteration of a longer series of so-called ‘innovations’ in digital identification. Mastercard is just one unfortunately-named company in this field; the reality is that virtually every industry has taken on the mission of digitization. And with developments in the field of artificial intelligence and the ongoing rollout of the Internet of Things (IoT), we are increasingly in a position where nothing we do in any context can ever be free of intrusion. Once you’re in, there’s no easy way of getting out.

This article started as a deep dive into New York’s Excelsior Pass. Mastercard was originally going to be simply a passing reference in the introduction to help set the context for vaccine passports in recent history. I didn’t expect to find such a robust history, and this is just going back to 2013. The piece was thus split in two, with next week’s Microjourney delving deep into the Excelsior Pass. But even more importantly, we will tackle a very important and thus far under-discussed question: if different regions across the world deployed entirely different versions of a vaccine passport — some limited to paper cards, others going full Green Pass — then is that not a signal that we’re still far off from the full implementation of a global digital passport?

And then the World Health Organization and European Commission came out with their announcement that they would immediately be scaling the EU COVID Pass to worldwide use. I couldn’t believe the timing. I promise, I didn’t cause this! But it emphasizes the importance of rapidly building our knowledge of what has been done already, in order to best understand what is likely to come next.

Soulful

Let’s close out today with a song of mine called “Soulful”, released as Track 3 of my album Foreverland. Listen through the YouTube video below, or stream/purchase the track at my Bandcamp!

Kyriakides, S. (2023, June 5). Press Statement by Commissioner Stella Kyriakides at the launch of the WHO Global Digital Health Certification Network. European Commission. https://web.archive.org/web/20230608050926/https://ec.europa.eu/commission/presscorner/detail/en/SPEECH_23_3085

Associated Press. (2023, May 5). WHO downgrades COVID pandemic, says it’s no longer a global emergency. CBC News. http://archive.today/2023.05.05-183043/https://www.cbc.ca/news/health/who-pandemic-not-emergency-1.6833321

Can the Visa-Mastercard duopoly be broken? (2022, August 17). The Economist. http://archive.today/2022.10.17-164602/https://www.economist.com/finance-and-economics/2022/08/17/can-the-visa-mastercard-duopoly-be-broken

Ekott, I. (2014, August 29). SCANDALOUS: Outrage in Nigeria as government brands National ID Card with MasterCard’s logo. The Premium Times, Nigeria. http://archive.today/2023.06.03-205357/https://www.premiumtimesng.com/news/headlines/167479-scandalous-outrage-in-nigeria-as-government-brands-national-id-card-with-mastercards-logo.html?tztc=1

MasterCard® Government Services & Solutions Case Study Nigeria National ID Card (NID). (2013). Smart Cities Council; MasterCard. https://web.archive.org/web/20230603223403/https://www.smartcitiescouncil.com/sites/default/files/public_resources/Nigerian%20National%20ID%20card_0.pdf

Ekeghe, N. (2022, July 20). Access Holdings Leads Tier-1 Banks with Largest Customer Base. This Day Live. https://web.archive.org/web/20220723145016/https://www.thisdaylive.com/index.php/2022/07/20/access-holdings-leads-tier-1-banks-with-largest-customer-base/

Home. Unified Payments Nigeria. Retrieved June 4, 2023, from https://web.archive.org/web/20230604001129/https://up-ng.com/

Eleanya, F. (2019, May 16). Inside Nigeria’s first ever fintech company. Businessday NG. https://web.archive.org/web/20190706031021/https://businessday.ng/technology/article/inside-nigerias-first-ever-fintech-company/

Access Bank. World Economic Forum. Retrieved June 3, 2023, from http://archive.today/2023.06.03-211345/https://www.weforum.org/organizations/access-bank-plc

Mastercard. World Economic Forum. Retrieved January 18, 2022, from https://archive.ph/uWiOP

First Bank of Nigeria. World Economic Forum. Retrieved November 19, 2022, from https://web.archive.org/web/20221119064254/https://www.weforum.org/organizations/first-bank-of-nigeria-plc

Standard Chartered Bank. (2021, March 12). World Economic Forum. Retrieved March 30, 2022, from https://archive.ph/x1jOO

Zenith Bank. World Economic Forum. Retrieved March 18, 2022, from http://archive.today/2022.03.18-012211/https://www.weforum.org/organizations/zenith-bank-plc

Standard Bank Group. World Economic Forum. Retrieved March 22, 2022, from http://archive.today/2022.03.22-145506/https://www.weforum.org/organizations/the-standard-bank-group-limited

Vrankulj, A. (2013, May 8). NIMC and MasterCard announce Nigerian national identity smart cards. Biometric Update. https://web.archive.org/web/20220901060644/https://www.biometricupdate.com/201305/nimc-and-mastercard-announce-nigerian-national-identity-smart-cards

Machan, R. (2012, October 1). 100 million Nigerians to be registered in new biometrics database. Biometric Update. https://web.archive.org/web/20221003044346/https://www.biometricupdate.com/201210/100-million-nigerians-to-be-registered-in-new-biometrics-database

Vrankulj, A. (2013, January 4). Nigerian Citizens to be issued unique national identity numbers. Biometric Update. https://web.archive.org/web/20220704210713/https://www.biometricupdate.com/201301/nigerian-citizens-to-be-issued-unique-national-identity-numbers

World Economic Forum on Africa 2013 - Partners. World Economic Forum. Retrieved June 3, 2023, from http://archive.today/2023.06.03-222109/https://www.weforum.org/events/world-economic-forum-on-africa-2013/partners

Evaluation of Gavi’s Private Sector Engagement Approach (2016-2020) Case Study Supplement (pp. 10–15). (2021). Mott MacDonald. https://web.archive.org/web/20230604203304/https://www.updwg.org/wp-content/uploads/2022/02/Evaluation-Gavi-PSEA-Case-Study-Supplement_Zipline-Rwanda-1.pdf

Gavi and Mastercard Join Forces to Reach More Children with Lifesaving Vaccines. (2018, December 11). Mastercard. http://archive.today/2023.03.16-153530/https://newsroom.mastercard.com/press-releases/gavi-and-mastercard-join-forces-to-reach-more-children-with-lifesaving-vaccines/

Salmon, F. (2018, December 16). Mastercard’s technology helps immunize the world’s poorest children. Axios. https://web.archive.org/web/20221205205050/https://www.axios.com/2018/12/16/mastercard-gavi-vaccine-partnership-world-poverty

Fauzia, M. (2020, September 9). Fact check: Mastercard’s partnership on vaccination records is unrelated to finances. USA TODAY. http://archive.today/2021.09.13-171634/https://www.usatoday.com/story/news/factcheck/2020/09/09/fact-check-mastercard-partnership-vaccines-unrelated-finances/5658366002/

Sen, C. (2019, June 7). Mastercard Digital Wellness Program to Enhance Transparency, Security and Choice for Online Shopping. Mastercard. https://web.archive.org/web/20230604005624/https://mastercardcontentexchange.com/news/press/2019/june/mastercard-digital-wellness-program-to-enhance-transparency-security-and-choice-for-online-shopping/

EMVCo Members. EMVCo. Retrieved February 15, 2016, from https://web.archive.org/web/20160215190249/http://www.emvco.com/about_emvco.aspx?id=156

Mastercard Boosts Security With Acquisition Of NuData. (2017, March 30). PYMNTS. https://web.archive.org/web/20201025141902/https://www.pymnts.com/news/partnerships-acquisitions/2017/mastercard-boosts-security-with-acquisition-of-nudata-internet-of-things-iot/

Vreeburg, R. (2019, September 25). Mastercard and Rabobank Join to Bring Financial Inclusion Tools to 1 Million Farmers. Mastercard. https://web.archive.org/web/20221128044635/https://newsroom.mastercard.com/press-releases/mastercard-and-rabobank-join-to-bring-financial-inclusion-tools-to-1-million-farmers-2/

Blumberg, D. L. (2023, January 4). How to turn farmers from price takers to price makers. Mastercard. https://web.archive.org/web/20230604225535/https://www.mastercard.com/news/perspectives/2023/mastercard-farm-pass-digital-farming/

Shared Solutions Unlock Economic Prosperity for Communities. (2019, October 16). Mastercard Center for Inclusive Growth. http://archive.today/2023.06.04-213843/https://www.mastercardcenter.org/insights/shared-solutions-unlock-economic-prosperity-for-communities

COVID-19 Therapeutics Accelerator. (2020, March 10). Bill & Melinda Gates Foundation. http://archive.today/2021.04.25-054406/https://www.gatesfoundation.org/Ideas/Media-Center/Press-Releases/2020/03/COVID-19-Therapeutics-Accelerator

Suzman, M. (2020, March 10). Announcing the COVID-19 Therapeutics Accelerator. Bill & Melinda Gates Foundation. http://archive.today/2022.01.18-165008/https://www.gatesfoundation.org/ideas/articles/coronavirus-mark-suzman-therapeutics

Staines, R. (2020, March 26). Pharma giants including Novartis collaborate on COVID-19 therapies. Pharmaphorum; Pharmaphorum Media Limited. https://archive.ph/8TAzM

Weintraub, J., & Tissandier, F. (2020, June 3). Private sector partners strengthen Gavi programmes with more than US$ 70 million in contributions. Gavi, the Vaccine Alliance. http://archive.today/2020.07.18-125751/https://www.gavi.org/news/media-room/private-sector-partners-strengthen-gavi-programmes-more-us-70-million-contributions

Mastercard. (2022, December 31). Gavi, the Vaccine Alliance. https://web.archive.org/web/20230517090032/https://www.gavi.org/investing-gavi/funding/donor-profiles/mastercard

Kloberdanz, K. (2020, June 26). Signed, Sealed, Encrypted: This Digital ID Is All Yours. Mastercard. http://archive.today/2020.08.17-154435/https://mastercardcontentexchange.com/perspectives/2020/signed-sealed-encrypted-this-digital-id-is-all-yours/

Public-private partnership launches biometrics identity and vaccination record system in West Africa. (2020, July 10). Privacy International. https://web.archive.org/web/20230604191655/https://privacyinternational.org/examples/4083/public-private-partnership-launches-biometrics-identity-and-vaccination-record-system

Overview. Trust Stamp. Retrieved June 4, 2023, from https://web.archive.org/web/20230604013431/https://investors.truststamp.ai/

Richardson, R. (2019, February 13). Mastercard Selects Token.io as a Partner for its New Open Banking Hub. Token. http://archive.today/2023.06.05-234834/https://token.io/press/mastercard-selects-token-io-as-a-partner-for-its-new-open-banking-hub-1

Hardy, Q. (2011, November 3). OneID Aims to Unite Devices to Fight Hackers. Bits Blog; New York Times. https://web.archive.org/web/20230607182405/https://archive.nytimes.com/bits.blogs.nytimes.com/2011/11/03/oneid-aims-to-unite-devices-to-fight-hackers/?_php=true&_type=blogs&_r=0

Blumberg, D., Drennan, T., Isaacs, D., Nisperos, A., & Conrad, K. (2021, December 1). TransUnion and Neustar Announce Transaction Close. Yahoo Finance. http://archive.today/2023.06.07-185848/https://finance.yahoo.com/news/transunion-neustar-announce-transaction-close-133500878.html?guccounter=1

Portfolio - Therapeutics. Khosla Ventures. Retrieved June 7, 2023, from https://web.archive.org/web/20230607220139/https://www.khoslaventures.com/category/therapeutics/

Company. Deep Genomics. Retrieved May 2, 2023, from https://web.archive.org/web/20230502153754/https://www.deepgenomics.com/company/

Square - Funding, Financials, Valuation & Investors. Crunchbase. Retrieved April 5, 2023, from https://www.crunchbase.com/organization/square/company_financials

Tile - Funding, Financials, Valuation & Investors. Crunchbase. Retrieved April 6, 2023, from https://www.crunchbase.com/organization/tile/company_financials

Our Corporate Innovation Partners. Plug and Play Tech Center. Retrieved June 6, 2023, from https://web.archive.org/web/20230606002503/https://www.plugandplaytechcenter.com/corporations/partners/

Our Corporate Innovation Partners. Plug and Play. Retrieved May 5, 2020, from https://web.archive.org/web/20200505014324/https://www.plugandplaytechcenter.com/corporations/partners/

IATA Travel Pass Initiative. International Air Transport Association. Retrieved April 10, 2021, from https://archive.ph/bzWzK

Bourgeois, A. Home. ELNA Medical. Retrieved October 8, 2022, from https://web.archive.org/web/20221008004320/https://elnamedical.com/en/

Loved your song!

You have a gentle clear voice and soul and yet you delve into these dark topics so well.

Clearly all of this has been in the works for years and to those who claim mass hypnosis or coincidence or snowball effect accounts for recent events, this post here today is evidence of their wrong wishful thinking.

Great research again, thank you.

i'm really enjoying these songs to close out each episode :) a refreshing beacon of light to guide one back after diving into such dark terrain. great job once again Liam!