Examining Effective Altruism - Part VI

Sam Bankman-Fried, Art of Problem Solving, Canada/USA MathCamp, Jane Street Capital

Rounding the Earth

The following article serves as the show notes for the video presentation of the same name released through the Rounding the News series, presented by Rounding the Earth. It is provided to allow RTE listeners to verify my sources and conduct their own due diligence, and is intended as a supplement to the video. As such, I highly encourage readers of this Substack to watch the full episode and support Rounding the Earth, whose founder Mathew Crawford has provided me the platform and resources to conduct this important work. Thank you, Rounding the Earth!

Sam Bankman-Fried

This is Part VI of the Examining Effective Altruism special investigation series on Rounding the News. Read the previous instalments here:

Part I - William MacAskill, Giving What We Can, 80,000 Hours, Y Combinator, Centre for Effective Altruism, and more...

Part II - The Social Network, revisionist history, Chris Hughes, LifeLog

Part III - Dustin Moskovitz, Cari Tuna, Good Ventures, GiveWell, Open Philanthropy

Part IV - Peter Singer: eugenics, bioethics, gene editing, euthanasia, infanticide. Meet the Godfather of Effective Altruism.

Part V - Joseph Bankman, Barbara Fried, legacy and utilitarianism, 2020 and 2022 elections

Sam Bankman-Fried (SBF) should require no introduction at this point. He is the founder of FTX and Alameda Research, two companies that engaged in widespread fraud and other alleged crimes that resulted in their collapse. The ripple effects continue to affect the economy at large.

Early years

SBF was born March 6, 1992 in Stanford, California, into a world informed by the ideologies, people and organizations described at length in the previous chapter of this series.

This is more literal than you might think, given that he was actually born on the campus of Stanford University.

A Yahoo! Finance article published in August 2021 characterizes the Bankman-Fried household as having been permeated by the “branches of moral philosophy” practiced by his parents - specifically, utilitarianism.1

In an interview, Barbara Fried says that while she herself has only been “inching toward” utilitarianism over her career, her husband and both of her sons have long been “take-no-prisoners utilitarians.”

“The ethical goal of utilitarians,” she explains in a followup email, “is to maximize the total well-being of the world’s people (and for some, animals as well). . . . That goal leads utilitarians to focus their efforts on helping people in the direst straits . . . and on policy interventions that will lower the risk of existential threats to present and future generations.”

Sound familiar? This is effective altruism. Or rather, a version of the philosophy that predates the modern “effective altruism movement.”

When Bankman-Fried was about 14, his mother says, she noticed that—completely on his own—he had been reading up in this area intensively.

He discovered the work of leading utilitarian Peter Singer — a contemporary, if not straight up colleague, of his mother’s — as a teenager, with Bloomberg describing him as SBF’s “capitalist muse.”2

Education

SBF attended Crystal Springs Uplands School, described as “a top Silicon Valley prep school.34 He registered a profile and engaged on an educational platform called the Art of Problem Solving (AoPS),5 whose first employee was none other than Rounding the Earth’s founder, Mathew Crawford.6

This is where we enter a strange phase of this investigation as I tiptoe into Mathew’s own history. I’ll let him speak to his experiences, failures, successes et al, while I focus on piecing together an understanding of the world of mathematics that spawned SBF.

Art of Problem Solving

As it turns out, AoPS is not an insignificant part of the story. The company was launched in May 2003 by a man named Richard Rusczyk,7 a former Senior Vice President at a multinational investment firm called D.E. Shaw & Co.8

In 2004, the National Security Agency (NSA) approached AoPS to take over the USA Mathematical Talent Search, leading to the formation of the Art of Problem Solving Foundation to run the event. The new organization was later renamed to the Art of Problem Solving Initiative.

In 2005, D.E. Shaw and Google sponsored the launch of AoPS’ Worldwide Online Olympiad Training (WOOT) program.910 Since then, WOOT's sponsors have included Jane Street Capital, Susquehanna International Group and Alameda Research (the company SBF would go on to create).11

In 2011, the AoPS Initiative launched the Bridge to Enter Advanced Mathematics (BEAM) program. BEAM is funded by the Bill & Melinda Gates Foundation, BlackRock and Jane Street Capital, and none other than SBF himself.12

SBF’s tenure using AoPS Online was February 22, 2009 to April 17, 2010.

Math Camp

While in high school, SBF attended the Canada/USA Mathcamp, described as “a summer program for mathematically proficient students,” where he met two future business partners: Sam Trabucco and Gary Wang.1314 Also in attendance with the group was Gabe Bankman-Friend, Sam’s brother, henceforth referred to as GBF.15

This matchmaking five-week summer math camp is the flagship program of the Mathematics Foundation of America,16 and has been funded in recent years by the American Mathematical Society, National Science Foundation and Wolfram Research.17

Mira Bernstein, the Foundation’s Executive Director at the time that SBF and friends attended, has her own interesting connections to the “effective altruism” network.18 She worked as an investigator and project manager for the Oregon Health Insurance Experiment at the National Bureau of Economic Research (NBER), an organization funded by effective altruism giant Open Philanthropy.19 The project was funded by a number of government agencies under the U.S. Department of Health and Human Services (HHS) and the Social Security Administration, as well as nonprofit organizations such as the California HealthCare Foundation, Robert Wood Johnson Foundation, Alfred P. Sloan Foundation and the Smith Richardson Foundation.20

Bernstein went on to work under the Center for Election Science on an electoral reform project for the Province of British Columbia. In Part III of this series, we found that the Center for Election Science had received at least two grants from Open Philanthropy, with a 2017 grant naming as principal investigator the modern godfather of effective altruism himself: William MacAskill.21

As I noted in the previous article, MacAskill returned to advocate for the group again in 2018 - the year of the mid-term elections in the US - on the official Effective Altruism Forum.22 This is the same election year that saw Barbara Fried form Mind the Gap, the super PAC that channeled millions of dollars intro Democratic candidates in 2018 and 2020 - including from several employees of FTX, Planned Parenthood, and D.E. Shaw & Co.23

CES has also received funding from Effective Altruism Funds and the FTX Foundation’s Future Fund.2425

University

Upon graduating from high school, SBF has said he suffered from a lack of direction. He claims to have flipped a coin to choose which university to apply to, with the Massachusetts Institute of Technology (MIT) winning out over the California Institute of Technology.26

He joined a fraternity at MIT called Epsilon Theta, through which he met another future FTX business partner, Adam Yedidia.27

Despite his initial hesitation, Yedidia joined FTX in January 2021. But prior to such ambitions, SBF started as a freshman at MIT in 2010.28 He is said to have shown a passion for board games, particularly those with a time limit - when SBF was playing, even games like Monopoly had a time limit introduced.

Meeting William MacAskill

As mentioned earlier, SBF had followed in his mother’s footsteps in studying utilitarianism, teaching himself about it from a young age. However, it was a chance meeting with William MacAskill that kickstarted his desire to apply this concept in its modern form of effective altruism.

During his third year at MIT, SBF attended a presentation delivered by MacAskill on the ethics of career choice (the irony is palpable).29 This happened in either 2012 or 2013, depending on who you ask.

Only months prior in October 2011, MacAskill had launched 80,000 Hours, an organization “designed to offer 'ethical life-optimisation' advice to undergraduates.” An offshoot of MacAskill's first effective altruism venture, Giving What We Can, 80,000 Hours achieved charitable status in 2012 and began touring around the world to pitch their proposals for how students should choose how to spend their career.30

A version of SBF’s introduction to MacAskill is available on the 80,000 Hours website:31

Our involvement started when Sam met Will MacAskill — co-founder of the Centre for Effective Altruism and 80,000 Hours — in 2013. Will had just given a talk about some of the ideas behind 80,000 Hours, including the idea of having a positive impact through earning to give.

As retold in an article published by Sequoia Capital, the pair then sat down for lunch “at the Au Bon Pain outside Harvard Square,” where “MacAskill laid out the principles of effective altruism (EA).”32 Instead of pursuing a job at the Humane League working to help animals (his plan at the time),33 MacAskill argued that SBF could make more of an impact by harnessing his mathematical skills to “get rich first himself, and then improve the world.” Or in the more diplomatic language of 80,000 Hours: "Sam was undecided about what to do after graduation, and became more convinced that, given his quantitative skills, earning to give could be the right first step."

Jane Street Capital

From there, SBF was introduced to “others interested in this path in the effective altruism community,” who told him about a trading firm called Jane Street Capital. He spent the summer of 2013 there as an intern, and was hired full-time upon his graduation from MIT in 2014.

Jane Street was already present on the fringes of SBF’s high school years through its partnerships with the Art of Problem Solving, and hand its hand in the extended math education network in which SBF came up. It co-sponsors the Math Prize for Girls at MIT and AoPS, for example - competitions and organizations closely aligned with and funded by intelligence agencies like the NSA, the Department of Defense STEM office, as well as military contractors like Raytheon, BAE Systems and Northrop Grumman.3435 The more I look at this network, the more I see the shape of a mathematics-military-industrial complex. And the more curious I am about each person and organization involved in it.

So who and what is Jane Street Capital? The firm was founded in August 1999 by Tim Reynolds, Rob Granieri, Marc Gerstein, and Michael Jenkins - all former employees of Susquehanna International Group (SIG), minus Gerstein, who worked at IBM.36 In an article published by Bloomberg in 2018, the firm is described as placing "an emphasis on undergraduate recruitment and puzzles," using Game Theory to guide its trades.37

At the core of Jane Street’s strategy is something called arbitrage, which means “making risk-less profits by solving market mispricings.”38 This is something that SIG is apparently famous for, and a skill that SBF allegedly used to build his initial capital, by taking advantage of the price difference between the Japanese and American Bitcoin markets.39

Perhaps unsurprisingly, Jane Street seemed all too aware of an impending market shakeup leading into the declared COVID-19 pandemic, walking away with more than $6 billion in profit in the first half of 2020.40 What may be surprising is how frequently Jane Street is painted as a mysterious entity that nobody's heard of.

This is found throughout news coverage of Jane Street over the last decade and a half or so. A February 2016 New York Times article calls the firm “secretive” and "super shy," having spent years “minting money in the shadows of Wall Street.” "Much of what Jane Street, which occupies two floors of an office building at the southern tip of Manhattan, does is not known."41

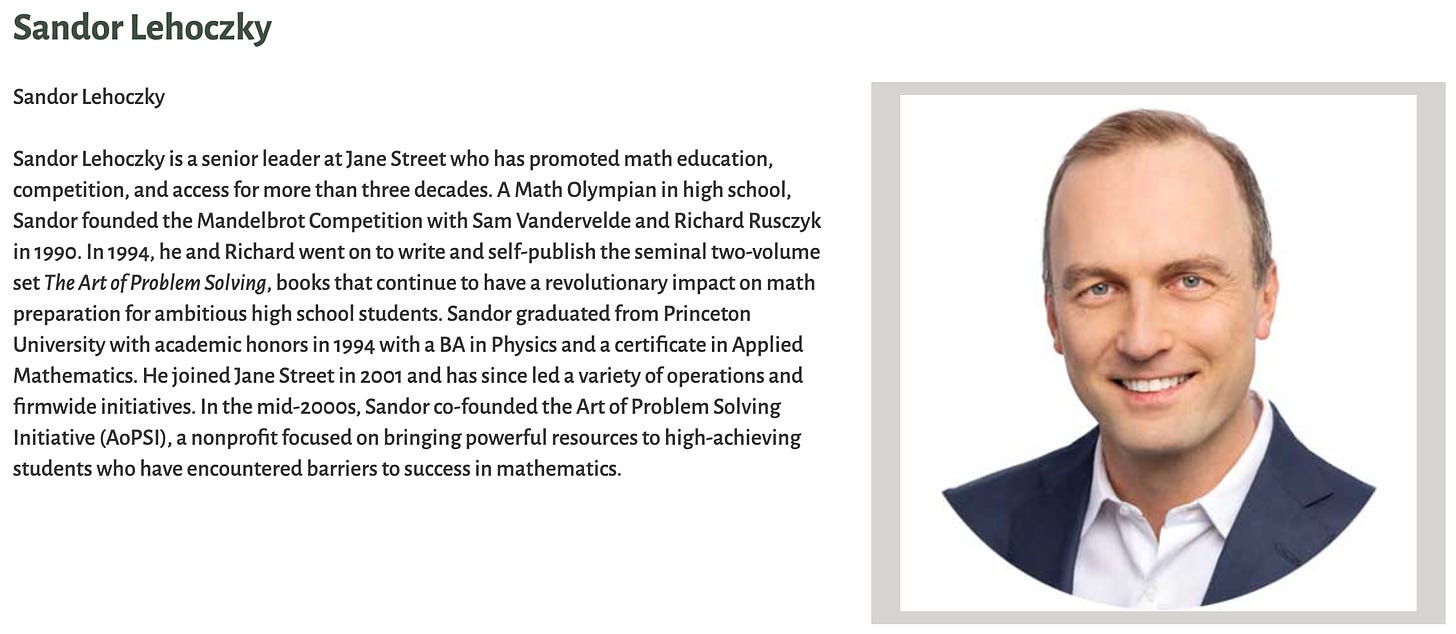

The article did, however, highlight a few of the public-facing members of the company. One of them was Sandor Lehoczky, described as “[standing] guard over the firm’s brain.” Lehoczky is a longtime colleague of Richard Rusczyk, with whom he co-wrote the first Art of Problem Solving books that led to the founding of AoPS.42 He was also the official founder of the Art of Problem Solving Initiative, created after AoPS was tapped by the National Security Agency to take over its USA Mathematical Talent Search.

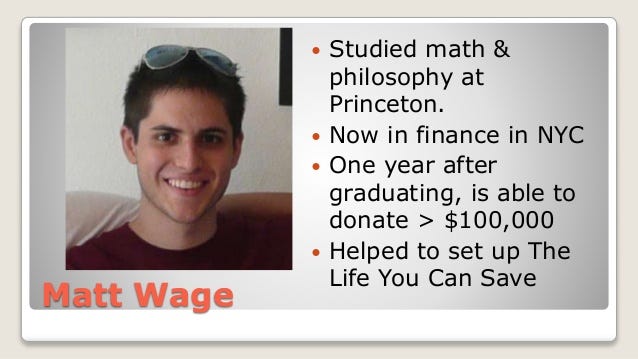

Jane Street seems to have become a breeding ground for young recruits into effective altruism. In previous instalments of this series, we talked about a young man named Matt Wage who went to work at Jane Street after studying under Peter Singer. He started at the firm in 2012. His reasoning for going to Jane Street was the same later applied by SBF: the quicker you can get rich, the quicker you can give half of it away.43 Wage is now a top donor to the Future of Life Institute, an effective altruism-focused organization, alongside power players like Open Philanthropy, Ethereum creator Vitalik Buterin, Elon Musk, Sam Harris and the Silicon Valley Community Foundation.44 He also claims to have been influenced by MacAskill's 80,000 Hours presentation.45

In fact, MacAskill actually credits Wage for opening the door for others in the effective altruism movement to take jobs at Jane Street.46 It seems likely that it was Wage and those who followed soon after him that paved the way for SBF to come onboard as well, leading MacAskill to tip him off to the opportunity.

According to Tom Gill, a former Jane Street employee who worked alongside SBF and future business partner Caroline Ellison, the pair were “very much into [Effective Altruism], a lot of people at Jane Street were, and that was typical.”47

According to the New York Times, SBF “built ties with more than half a dozen colleagues with similar views, who later became part of the FTX universe.”

Ellison, of course, was one. She had joined the firm in 2016 right after graduating from Stanford University. SBF also bonded with a coworker named Brett Harrison, with whom he shared a passion for animal rights.

Thus, a ragtag group of young “effective altruists” banded together under the exciting and risk-focused roof of Jane Street Capital. This merging of worlds, Wall Street and philanthropy, was set to take on a new face under the apparent leadership of Sam Bankman-Fried.

To be continued.

If you’ve enjoyed this article, don’t forget to join us over at our Rounding the Earth Locals community!

Parloff, R. (2021, August 12). Portrait of a 29-year-old billionaire: Can Sam Bankman-Fried make his risky crypto business work? Yahoo! Finance. https://archive.ph/jAPFn

Faux, Z. (2022, April 3). A 30-Year-Old Crypto Billionaire Wants to Give His Fortune Away. Bloomberg. https://archive.ph/uvIOa

Chittum, M. (2022, December 14). Sam Bankman-Fried attended a top Silicon Valley prep school where his senior class prank reportedly included making $100 bills with his face on them called “Bankmans.” Markets Insider. https://archive.ph/MrYWB

SamBF. (2009, February 23). Bay Area High School Puzzle Hunt. Art of Problem Solving. https://archive.ph/2gnzu

User Profile - SamBF. Art of Problem Solving. Retrieved January 10, 2023, from https://web.archive.org/web/20230110014508/https://artofproblemsolving.com/community/user/57409

Mathew Crawford. Art of Problem Solving. Retrieved January 11, 2023, from http://archive.today/2023.01.11-222604/https://artofproblemsolving.com/wiki/index.php/Mathew_Crawford

History of Art of Problem Solving. AoPS. Retrieved March 22, 2023, from https://web.archive.org/web/20230322215644/https://artofproblemsolving.com/company/history

Richard Rusczyk. LinkedIn. Retrieved March 22, 2023, from https://www.linkedin.com/in/richard-rusczyk-9210a06/

WOOT. Art of Problem Solving. Retrieved June 18, 2022, from https://web.archive.org/web/20220618192540/https://artofproblemsolving.com/woot

Surhone, L. M., Tennoe, M. T., & Henssonow, S. F. (2011). Worldwide Online Olympiad Training. Betascript Publishing. http://archive.today/2023.03.22-221351/https://www.morebooks.de/shop-ui/shop/product/978-613-4-55281-3

WOOT: Worldwide Online Olympiad Training. Art of Problem Solving. Retrieved April 6, 2022, from https://web.archive.org/web/20220406115408/https://artofproblemsolving.com/school/woot

Our Supporters. Bridge to Enter Advanced Mathematics. Retrieved January 14, 2023, from https://archive.ph/QwD9p

McMahon, K., & Huang, V. G. (2021, December 28). Here are 10 of the most surprising little-known facts we learned about the 29-year-old crypto billionaire Sam Bankman-Fried after months speaking to his closest friends, family, and colleagues. Business Insider. http://archive.today/2021.12.29-014820/https://www.businessinsider.com/crypto-trading-billionaire-sam-bankman-fried-ftx-alameda-surprising-facts-2021-12

Bankman-Fried, S. (2020, May 17). Raising the bar. FTX Research. https://web.archive.org/web/20221125085649/https://blog.ftx.com/blog/raising-the-bar/

Schleifer, T. (2023, February 1). The Brothers Bankman-Fried. Puck. http://archive.today/2023.02.05-032458/https://puck.news/the-brothers-bankman-fried/

Ways to Contribute. Canada/USA MathCamp. Retrieved January 11, 2023, from https://web.archive.org/web/20230111225911/https://www.mathcamp.org/giving/ways_to_contribute/

Our Supporters. Canada/USA MathCamp. Retrieved September 29, 2020, from https://web.archive.org/web/20200929143305/https://www.mathcamp.org/giving/our_supporters/

Mira Bernstein. LinkedIn. Retrieved January 11, 2023, from https://www.linkedin.com/in/mira-bernstein-1550a1137/

Oregon Health Insurance Experiment - Authors. National Bureau of Economic Research. Retrieved January 12, 2023, from https://web.archive.org/web/20230112005151/https://www.nber.org/programs-projects/projects-and-centers/oregon-health-insurance-experiment/oregon-health-insurance-experiment-authors

Oregon Health Insurance Experiment - Funding. National Bureau of Economic Research. Retrieved January 12, 2023, from https://web.archive.org/web/20230112005210/https://www.nber.org/programs-projects/projects-and-centers/oregon-health-insurance-experiment/oregon-health-insurance-experiment-funding

The Center for Election Science — General Support. (2017, December). Good Ventures. https://www.goodventures.org/our-portfolio/grants/the-center-for-election-science-general-support

aaronhamlin. (2018, December 15). Why You Should Invest In Upgrading Democracy And Give To The Center For Election Science. Effective Altruism Forum. https://web.archive.org/web/20221206184145/https://forum.effectivealtruism.org/posts/jSjBHmgu3ZGcrW4t2/why-you-should-invest-in-upgrading-democracy-and-give-to-the

Organizations Disclosing Donations to Mind the Gap, 2020. OpenSecrets. Retrieved December 23, 2022, from https://web.archive.org/web/20221223085604/https://www.opensecrets.org/outside-spending/detail/2020?cmte=C00683649&tab=donors_all

Grants Database. Effective Altruism Funds. Retrieved December 25, 2022, from https://web.archive.org/web/20221225054148/https://funds.effectivealtruism.org/grants

Our Grants and Investments. Future Fund. Retrieved September 10, 2022, from https://web.archive.org/web/20220910082348/https://ftxfuturefund.org/our-grants/?_funding_stream=ad-hoc

Lee, I. (2021, August 14). From all-night gaming sessions to a life-changing epiphany: Inside the college years of 29-year-old crypto billionaire Sam Bankman-Fried. Markets Insider. http://archive.today/2023.03.23-044458/https://markets.businessinsider.com/news/currencies/sam-bankman-fried-profile-details-college-years-cryptocurrency-billionaire-ftx-2021-8

Parloff, R. (2021, August 12). Portrait of a 29-year-old billionaire: Can Sam Bankman-Fried make his risky crypto business work? Yahoo News. http://archive.today/2023.03.23-045609/https://ca.news.yahoo.com/ftx-ceo-sam-bankman-fried-profile-085444366.html?guccounter=1

Sam Bankman-Fried. LinkedIn. Retrieved March 23, 2023, from https://www.linkedin.com/in/sam-bankman-fried-8367a346/

Ahmed, A. (2022, November 18). William MacAskill’s ineffective altruism. UnHerd. http://archive.today/2022.11.18-215512/https://unherd.com/2022/11/how-effective-is-william-macaskills-altruism/

About us: what do we do, and how can we help? 80,000 Hours. Retrieved November 25, 2022, from https://80000hours.org/about/

Sam Bankman-Fried. (2014, October). 80,000 Hours. http://archive.today/2022.11.23-033921/https://80000hours.org/stories/sam-bankman-fried/

Fisher, A. (2022, September 22). Sam Bankman-Fried Has a Savior Complex—And Maybe You Should Too. Sequoia Capital US/Europe. https://archive.ph/2022.11.10-002447/https://www.sequoiacap.com/article/sam-bankman-fried-spotlight/

Gose, B. (2013, November 3). A New Donor Movement Seeks to Put Data Ahead of Passion. The Chronicle of Philanthropy. http://archive.today/2021.07.27-093425/https://www.philanthropy.com/article/a-new-donor-movement-seeks-to-put-data-ahead-of-passion/

Sponsors. Math Prize for Girls - Official Site - Advantage Testing Foundation/Jane Street. Retrieved October 13, 2022, from https://web.archive.org/web/20221013030034/https://mathprize.atfoundation.org/about/sponsors

Our Sponsors. MATHCOUNTS Foundation. Retrieved September 18, 2021, from https://web.archive.org/web/20210918054216/https://www.mathcounts.org/about/our-sponsors

Delaware Department of State: Division of Corporations. (2022, December 4). JANE STREET CAPITAL, LLC. OpenCorporates. http://archive.today/2023.03.23-221930/https://opencorporates.com/companies/us_de/3091466

Massa, A. (2018, November 20). The Poker Aces Playing a Key Hand in the $5 Trillion ETF Market. BNN Bloomberg. https://web.archive.org/web/20230323222357/https://www.bnnbloomberg.ca/the-poker-aces-playing-a-key-hand-in-the-5-trillion-etf-market-1.1170906

Hide Not Slide. (2021, June 11). Jane Street & The Arbitrage Royal Family. Substack. http://archive.today/2021.06.21-002037/https://frontmonth.substack.com/p/jane-street-and-the-arbitrage-royal

VegaX Holdings. (2021, October 11). How SBF Used The Kimchi Premium And Other Crypto Arbitrage Techniques To Succeed In The Crypto…. Medium. https://web.archive.org/web/20221229000143/https://vegaxholdings.medium.com/kimchi-premium-crypto-arbitrage-techniques-b780a45b6e76

Wigglesworth, R. (2021, January 28). Jane Street: the top Wall Street firm “no one’s heard of.” Financial Times. http://archive.today/2021.02.03-060847/https://www.ft.com/content/81811f27-4a8f-4941-99b3-2762cae76542?shareType=nongift

Thomas, Jr., L. (2016, February 22). A New Breed of Trader on Wall Street: Coders With a Ph.D. The New York Times. http://archive.today/2018.05.11-235241/https://www.nytimes.com/2016/02/23/business/dealbook/a-new-breed-of-trader-on-wall-street-coders-with-a-phd.html

Sandor Lehoczky. Advantage Testing Foundation. Retrieved March 23, 2023, from http://archive.today/2023.03.23-230048/https://www.atfoundation.org/people/board/sandor-lehoczky

Kristof, N. (2015, April 5). Opinion | The Trader Who Donates Half His Pay. The New York Times. http://archive.today/2015.05.01-080619/http://www.nytimes.com/2015/04/05/opinion/sunday/nicholas-kristof-the-trader-who-donates-half-his-pay.html?_r=0

Top Donors. Future of Life Institute. Retrieved December 10, 2022, from https://web.archive.org/web/20221210073211/https://archive.futureoflife.org/team/top-donors/

D’Urso, J. (2015, July 27). Young, smart and want to save lives? Become a banker, says philosopher. Reuters. https://www.reuters.com/article/us-global-charities-altruism-idUKKCN0Q10M220150727

Rennison, J., Yaffe-Bellany, D., & Goldstein, M. (2023, February 21). “Effective Altruism” Led Bankman-Fried to a Little-Known Wall St. Firm. The New York Times. http://archive.today/2023.02.22-010711/https://www.nytimes.com/2023/02/21/business/bankman-fried-altruism-jane-street.html

Jeans, D. (2022, November 18). Meet Caroline Ellison, The “Fake Charity Nerd Girl” Behind The FTX Collapse. Forbes. https://web.archive.org/web/20230323231943/https://www.forbes.com/sites/davidjeans/2022/11/18/queen-caroline-the-risk-loving-29-year-old-embroiled-in-the-ftx-collapse/?sh=5c21d302791f

Well, if someone had any doubt you took your background checks duties seriously, they are now relieved 😋

Congrats, excellent work!

You do know they are all or at least 90% Jews?

Altruism & greedy Jews don't go hand in glove...

It is like saying... I am a good thief... Robin Hood...

You are still a thief... as they are...

Stealing from the poor to give to the rich... this is their version of Altruism...

Head over heals.

Good article thought...

It's a family business

https://fritzfreud.substack.com/p/family-values